If you are a company or a business that hires workers in the Philippines, familiarizing yourself with its government-mandated employee benefits (or statutory benefits) is a must.

Key Points

- Employers in the Philippines need to remit contributions to agencies like SSS, PhilHealth, and Pag-IBIG on behalf of the employees.

- It is the employer’s duty to correctly compute withholding taxes from employee salaries and remit the same to BIR.

- Philippine employees are entitled to 13th-month, holiday, night differential, and overtime pay.

- Employees in the Philippines are also entitled to service incentive leaves, maternity leave, and paternity leave.

- The local retirement age is 60, while the mandatory retirement age is 65.

Statutory benefits are paid monthly, with the employee and the employer shouldering the cost. Under the Labor Code of the Philippines, a worker has rights to various statutory monetary benefits. Below is an in-depth discussion of each of them.

The mandatory benefits in the Philippines are an extensive topic. For instance, there are mandatory government program benefits, pay, and leave benefits, among others. Let’s start with the basics of employee benefits and what benefits are under Philippine Labor Laws.

What are employee benefits Philippines?

Employee benefits are vital components of an employment package that aim to improve employees’ overall satisfaction and welfare. These are non-wage benefits that supplement the salary package. These may include retirement plans, health insurance, paid time off, and other benefits, such as gym memberships.

Government-Mandated Benefits: Government Program Benefits

For employers operating in the Philippines, employee benefits are one of the most crucial things to get familiar with. These mandatory employee benefits are guaranteed by labor laws and are automatically deducted from the salaries of employed persons.

This is to ensure that employees get health insurance, free medical care, social security, and access to housing loans and affordable house financing.

Social Security System (SSS)

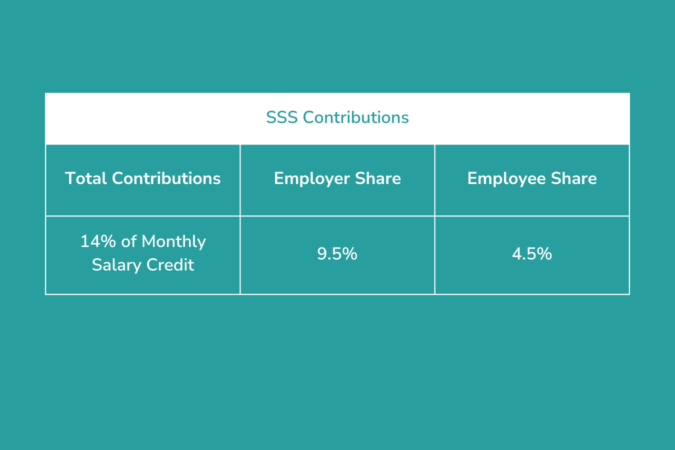

As of 2024, the member contribution for SSS amounts to 14% of their monthly salary credit (MSC). But this is not shouldered by the worker alone. Employees and employers split monthly contributions for SSS.

Moreover, 9.5% of this total amount is shouldered by the employer, while the remaining 4.5% is from the employee’s salary.

To be qualified for SSS, the minimum salary credit is Php 4,000, while the maximum is Php 30,000.

The Philippines’ Social Security Program package covers the following:

- Death benefits

- Sickness benefits

- When members develop permanent disabilities

- Maternity Benefits

- Old age or retirement benefits

- Unemployment benefits

In any of these events, SSS provides beneficiaries with financial assistance to cover the worker’s lost income. Qualified self-employed workers and employees are eligible to the above benefits.

SSS covers private workers, regardless if they are permanent, temporary, or provisional employees. For disabilities, the benefits vary depending if it is a partial or total permanent disability.

The same applies in the case of death. Only the benefit goes to the primary beneficiaries of the deceased. Lastly, SSS also covers a member’s retirement benefits, maternity benefits, and minimum monthly pension.

Check our article on SSS contributions and computations and generating your PRN.

PhilHealth Benefits

The Philippine Health Insurance Commission (PHIC), or PhilHealth, is a commission with the mandate to provide health insurance for all Filipinos. As the Philippines’ health insurance program, all private and public employers operating in the Philippines are required to register with PhilHealth.

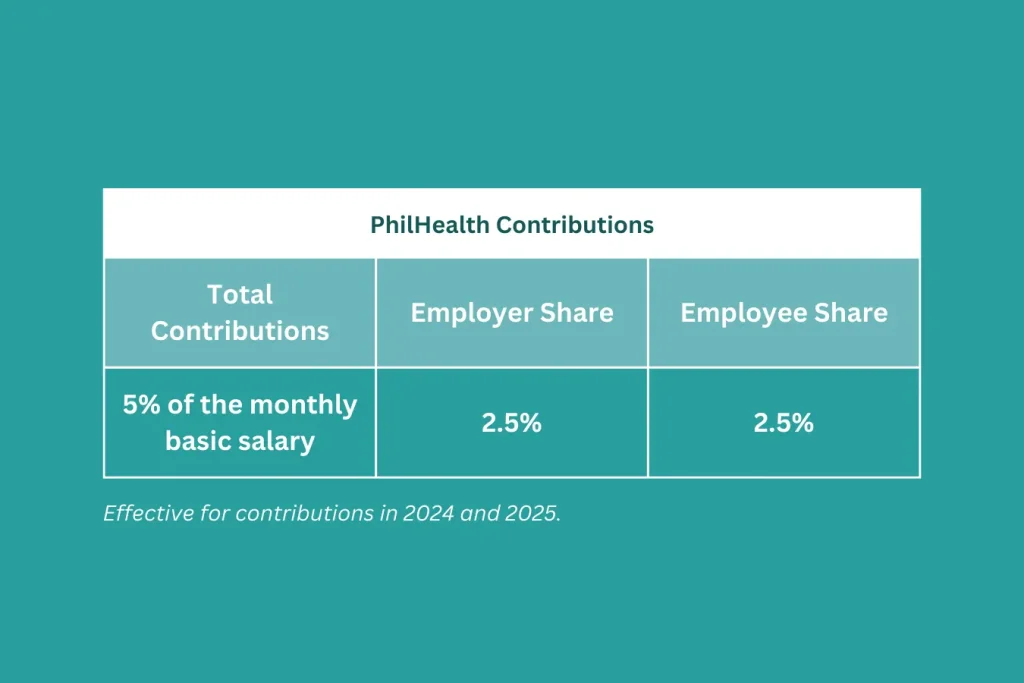

As of 2024, the contribution rate for PhilHealth is at 5%, which is a 1% increase from the years prior. This increase is in accordance with the Universal Health Care Law. However, the employee does not shoulder the entirety of this amount as the total due is divided between the employer and the employee.

In short, the employer pays 50% of the PhilHealth contribution, and the other 50% is deducted from the employee’s monthly salary. The minimum income for a PhilHealth contribution is Php 10,000, while the maximum income is Php 100,000.

PhilHealth Contribution CalculatorAlso known as the Philippine Health Insurance Corporation (PHIC), PhilHealth is a corporation that is owned and controlled by the government. It was created through the National Health Insurance (NHI) Act of 1995, otherwise known as Republic Act 7875.

Aside from government health insurance plans, the employer may also get private health insurance for their employees. In this case, they will shoulder the cost or split with the employees. Such extended healthcare coverage usually provides sickness benefits and covers other medical expenses.

Check out our article on monthly PhilHealth computations, or read more on the EPRS guide for employers.

Pag-IBIG Benefits

Filipino employees also need to contribute to the Home Development Mutual Fund (HDMF), or what is commonly known as the Pag-IBIG Fund. This is a mandatory mutual savings fund with housing as the primary investment. Generally, employees who are qualified for SSS are also mandated to sign up as members of Pag-IBIG.

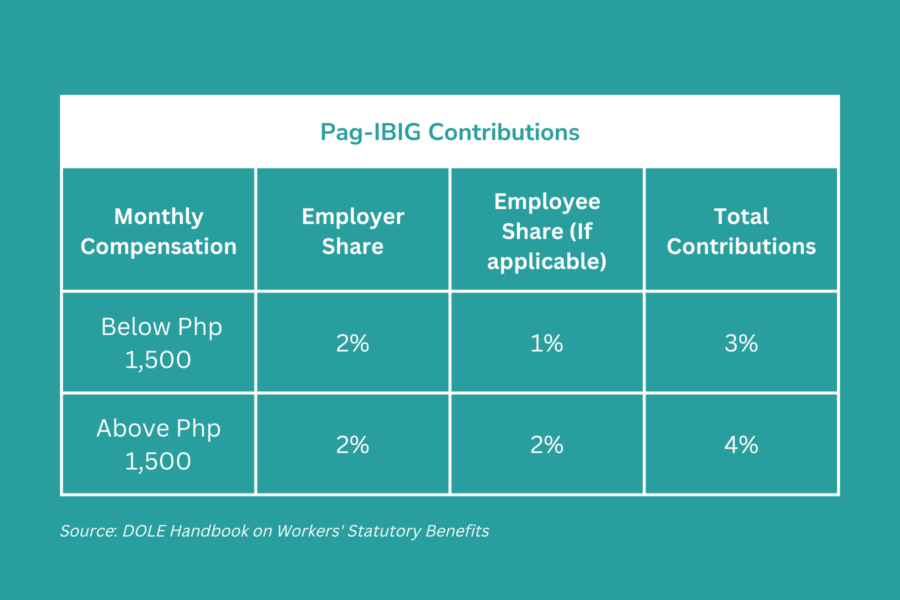

As of 2024, the contribution for Pag-IBIG is 4% of the employee’s monthly income, with the employee paying 2% and the employer shouldering the other 2%. This is applicable to employees earning at least Php 1,500 monthly.

Pag-IBIG CalculatorAlternatively, workers earning a monthly salary of Php 1,500 and below only contribute 3% of their salary, with the employer paying 2% and the employee contributing 1%.

The current maximum compensation for the monthly contribution is Php 5,000, meaning that the maximum member and employer contributions are both Php 100.

2024 Pag-IBIG Contribution Rate

Starting this 2024, however, the agency plans to increase the salary credit from Php 5,000 to Php 10,000. As a result, this would also increase the contribution amount for employees earning Php 10,000 and up from Php 100 to Php 200 with the 2% employee contribution rate. Businesses that employ Filipino workers locally will also have to pay the remaining 2% for a total of Php 400 in total contribution.

Learn more about Pag-IBIG contributions computations and schedule.

The benefits under Pag-IBIG include the following:

- Savings or Provident Savings Program

- Short-Term Loan Programs

- Housing Programs

Government-Mandated Benefits: Mandatory Pay Benefits

Minimum Wage

The minimum wage in the Philippines follows the rules under the Republic Act 6727 or the Wage Rationalization Act. This law fixes the applicable minimum wage if workers across different sectors, depending on the capitalization, number of workers, or gross sales. With the minimum wage, the law protects workers against unreasonably low pay.

For non-agricultural sectors in the Philippines, the minimum daily wage ranges from Php 282.00 to Php 340.00 at the lowest.

Meanwhile, the highest minimum daily wage ranges from Php 533.00 to Php 610.00 in the National Capital Region (NCR).

Related: DOLE Minimum Wage Rules

Holiday Pay

Workers in the Philippines are also entitled to holiday pay. Given this, employers pay the regular daily wage of an employee for any regular unworked holiday. Should employees work during regular holidays, they are entitled to at least twice (or 200%) of their daily wage.

Furthermore, should the holiday fall on the employee’s scheduled workday, the employee who works on the said day should get an additional 30% at the least of the regular holiday pay. In other words, a minimum of 260% of their daily pay.

Lastly, when two holidays overlap, the worker is entitled to at least 200% of their daily wage even if they do not work for the said day. Alternatively, the worker gets 100% of their daily wage if they are required to work on the said day.

Read more on holiday pay computations.

Overtime Pay

Workers in the Philippines usually have eight-hour shifts, excluding breaks. Any work rendered beyond these eight hours is considered overtime. Given that, any employee who works overtime is entitled to premium pay.

Employees working in excess of eight hours on an ordinary working day get a minimum of an additional 25% of their hourly rate.

On the other hand, workers rendering in excess of the regular eight hours on a scheduled rest day or special holiday are entitled to at least an additional 30% of their regular hourly rates.

Check out this blog for an in-depth discussion of overtime pay.

Night Shift Differential

Night shift differential (NSD) is the additional pay for employees working between 10:00 PM and 6:00 AM.

Employees in the Philippines working within these hours get an additional 10% of their regular wage for the individual hours worked.

Like the regular shifts, holidays, rest days, and overtime pay are stackable. As a result, employees working night shifts during double holidays and rest days could get as high as 429%.

On the other hand, overtime night shifts during a double holiday or a rest day guarantee that the employee receives at least an additional 507% of their regular wage.

eezi HR Guide

Learn how to make a simple yet compliant pay slip for your employees.

Government-Mandated Benefits: Statutory Leave Benefits

Service Incentive Leave

Service Incentive Leaves are a type of paid leave Filipino employees receive once they have put in at least a year of service. Usually, the law guarantees a minimum of five days of paid leave. One year of service here means 12 months of either continuous or broken work days.

Furthermore, this also factors in approved absences, rest days, and paid holidays. These may be consumed as paid sick leave or vacation leave.

Otherwise, service incentive leaves may be converted into cash on a pro-rata basis.

Maternity Leave

Any female employee, regardless of civil status and child legitimacy, is covered by maternity leave benefits. As such, they are granted 105 days of leave with full pay.

Furthermore, solo female parents get an additional 15 days of leave.

Lastly, an additional 60 days with full pay is granted to employees who have miscarriages or those who have to undergo an emergency termination of pregnancy.

Should the employee need an extended leave in cases of childbirth, they can extend up to 30 days but without pay.

Related: Expanded Solo Parents Act in the Philippines

Other Benefits that are specific to women:

- Leave for VAWC

- Special Leave for Women

Paternity Leave

Married male employees working in the private sector in the Philippines are entitled to a paternity leave of up to 7 calendar days. During these days, the male employee will receive his full pay, regardless of his employment status in the company.

The same also still applies in cases where the husband does not presently live with the wife because of his occupation.

However, the paternity leave should only apply to the first four deliveries of his lawful wife. Furthermore, paternity leave can only be used by the employee after the delivery of the child.

Parental Leave

For other cases of parental leave where a solo parent is alone and responsible for parenthood, the employee is granted seven days of fully paid leave every year.

This leave, however, is not convertible to cash, and employees can only avail of it after they have rendered a year of service in the company. Should the parenthood status of the employee change, this benefit is also terminated.

eezi HR Guide

Learn the efficient ways to set up your HR department.

Government-Mandated Benefits: Bonuses and Other Guaranteed Benefits

13th Month Pay

All employers in the Philippines are mandated to pay rank-and-file employees 13th-month pay, regardless of employment nature. The labor laws only require that the employee has worked for at least one month in a calendar year.

Furthermore, the 13th-month pay should be given not later than December 24 of the given year. The 13th-month pay should at least equal one-twelfth of the employee’s basic annual salary.

Alternatively, employers may give out half of the 13th-month pay in time for the regular school year and the remaining half before December 24 of the same year. Lastly, a 13th-month pay that is not greater than Php 90,000 is exempted from tax.

Income Tax (TRAIN) CalculatorSeparation Pay

An employee in the Philippines is entitled to separation pay, depending on the reason for their termination.

Suppose their termination is for a just cause like neglect of duty, fraud, or crime. In that case, the employer does not owe them any separation pay.

Alternatively, termination for authorized causes entitles the employee to separation pay.

The pay is the one-half month for each year of the employee’s service in the company. In general, below are the authorized causes to guarantee a separation pay:

- Retrenchment to prevent losses

- Closure or cessation of operation due to losses

- When the employee has a disease that is incurable within six months

- Lack of service assignment for six months for security guard

Retirement Pay

Employees in the Philippines retire when they reach 60 years old. Furthermore, retirement should not be beyond 65 years old. The law also requires that the employee has served the company for a minimum of five years to be entitled to retirement pay.

All private employers are mandated to provide retirement pay, except for establishments in the retail, service, and agriculture industries with ten or fewer employees.

The retirement pay should then be one-half of the employee’s latest monthly salary for every year of their service in the company.

These retirement benefits are also separate from those granted by SSS. Furthermore, the retiring employee is also entitled to their pro-rated 13th-month pay upon optional or compulsory retirement.

Related:

- DOLE Rules on Back Pay Computation

- Rules on Issuing Certificate of Employment

- Rules for First-time Jobseekers in the Philippines

Do mandatory employee benefits vary between private employees?

Yes, the benefits of private employees vary from those of government employees. Aside from the employee benefits mentioned above, many employers may also provide additional benefits to attract people, such as a group life insurance or a quarterly rice subsidy.

Employee benefits for private employees

Private employee benefits in the Philippines have a more extensive scope. For instance, the benefits stated above are all applicable to private employers, save a few exemptions.

However, public employees do not have the same set of benefits they are entitled to.

Employee benefits for government employees

For one, government employees are not entitled to holiday pay, premium pay, night shift differential, and 13th-month pay. Furthermore, they are also exempt from service incentive leaves.

Lastly, government employees are not entitled to retirement pay, and their retirement benefit packages are covered by the Government Service Insurance System (GSIS) instead of SSS.

Are overseas Filipino workers required to pay the mandatory contributions?

Overseas Filipino Workers or OFWs are required to register and pay contributions to the basic mandatory benefits, provided that they are not over 60. This includes monthly payments to SSS, PhilHealth, and Pag-IBIG. Furthermore, OFWs may be charged different rates for these contributions.

FAQs

General questions

What are employee benefits?

Employee benefits are non-wage benefits that supplement the salary package. These may include retirement plans, health insurance, paid time off, and other benefits, such as gym memberships.

Who is entitled to benefits?

The Department of Labor and Employment administers the Philippines’ labor laws. Employee benefits in the Philippines vary depending on the type of employment arrangement in place: regular, project-based, seasonal, or casual.

Laws and regulations may vary based on the nature of the employment situation. However, the law respects the job stability provided by any employment contract.

The Philippines Labor Code Book 3 specifies the general minimum employment conditions, including working hours, rest periods, overtime, age, night shift, holidays, and leave. Exceptions may be provided for managerial staff, field personnel, and certain other workers.

What are the guaranteed employee benefits in the Philippines?

The Philippines’ guaranteed benefits include 13th-month pay, social security (SSS), health insurance (PhilHealth), and Home Development Mutual Fund (Pag-IBIG) contributions.

Why is it necessary to update a company’s employee benefits package?

Updating or adjusting benefits is critical for businesses to remain competitive in attracting and retaining employees, as it ensures that their offerings are in line with market norms and employee expectations.

Keep your company compliant with eezi

Avoid discrepancies and stay up to date with government-mandated benefits by enrolling your organization in eezi. Our payroll module automatically calculates all applicable deductions so that all you have to do is add employees and run payroll.