See the Pag-IBIG contribution schedule and learn how to calculate deductions to understand the components of your payroll better.

What is the Pag-IBIG Fund?

Pag-IBIG is short for Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya, at Gobyerno Fund. It is also known as the Home Development Mutual Fund (HDMF). As such, the Pag-IBIG contribution is also the HDMF contribution table.

Simply, Pag-IBIG is a government-initiated savings program. Furthermore, its mandate mainly aims to help Filipinos save up for their own homes or shelter.

The HDMF Law of 2009, signed by then-President Gloria Macapagal Arroyo, mandates that all employees covered by SSS and GSIS, uniformed personnel of the AFP, PNP, BJMP, and BFP, and Filipinos with foreign employers have a membership in the Pag-IBIG Fund program.

2023 contribution for members

The Board of Trustees has set the contribution rates at a minimum of 1% and a maximum of 2% of their monthly income for members without employers. The same is also true for OFWs whose employers are not under mandatory coverage.

Furthermore, employed individuals and OFWs whose employers are under mandatory coverage have a contribution rate of 3%. Additionally, the maximum is 4% of the monthly compensation, which is shared between the employee and the employer.

The maximum amount of monthly compensation or income considered on which the contribution rate is applied is Php 5,000. In addition, members whose monthly salaries or income exceed Php 5,000 still have their total contribution rate at 4% of Php 5,000.

2024 contribution for members

The same rate percentages apply for 2024. However, the fund has increased its monthly fund salary (MFS) cap from Php 5,000 to Php 10,000. As a result, the contribution rates will also double, assuming the employee earns at least Php 10,000 and above every month.

Suppose an employee earns over Php 10,000; the new contribution amount is now Php 200. In other words, it has doubled from the previous year’s contribution amount.

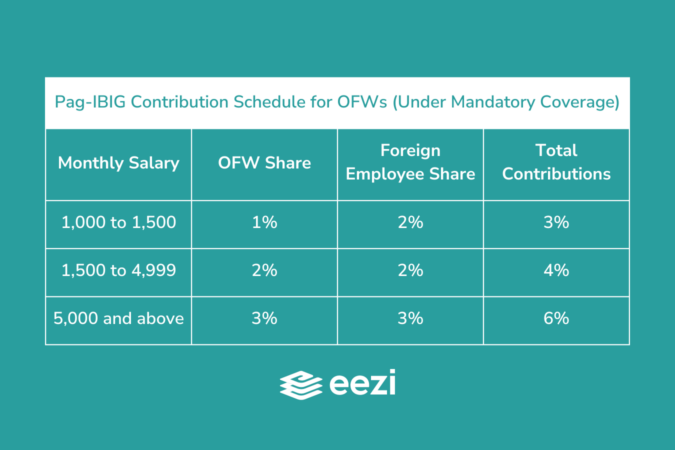

Monthly contribution for employers, employees, and OFWs with mandatory coverage

For regular employer employees and OFWs with mandatory coverage whose monthly salary is Php 1,500 or less, the total contribution is computed at 3% of the monthly salary, with the employer paying 2% and the employee paying 1%.

For those earning over Php 1,500, the total contribution rate is 4% of the monthly salary, with the employer and the employee paying 2% each.

These new rates ensure that members have higher savings and benefits available to them upon membership maturity.

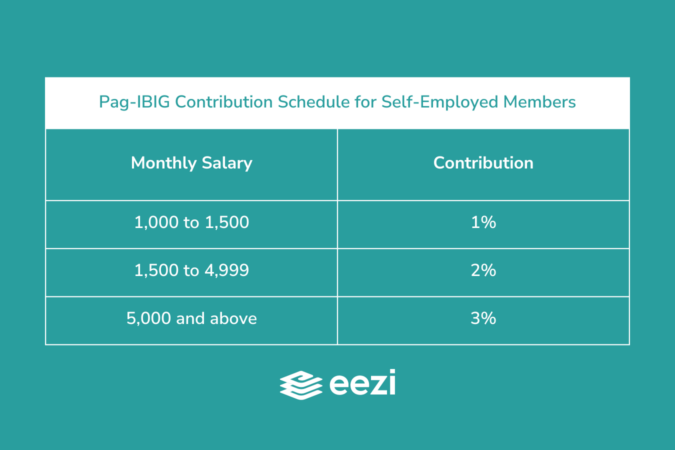

Monthly contribution for self-employed individuals

Mandatory HDMF coverage for Self-employed individuals starts with those earning at least Php 1,000 per month. The contribution rate for self-employed individuals is 1% of their monthly income for those earning Php 1,500 or less. Furthermore, it is 2% for those making greater than Php 1,500.

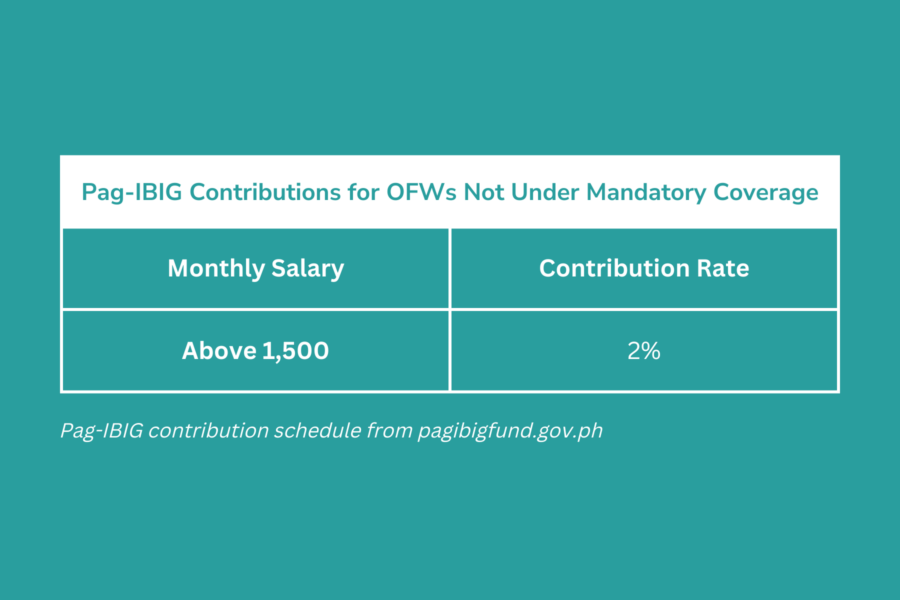

Monthly contribution for OFWs not under mandatory coverage

Overseas Filipino Workers whose employers are not under mandatory HDMF coverage must pay 2% of their monthly compensation as their monthly HDMF contribution.

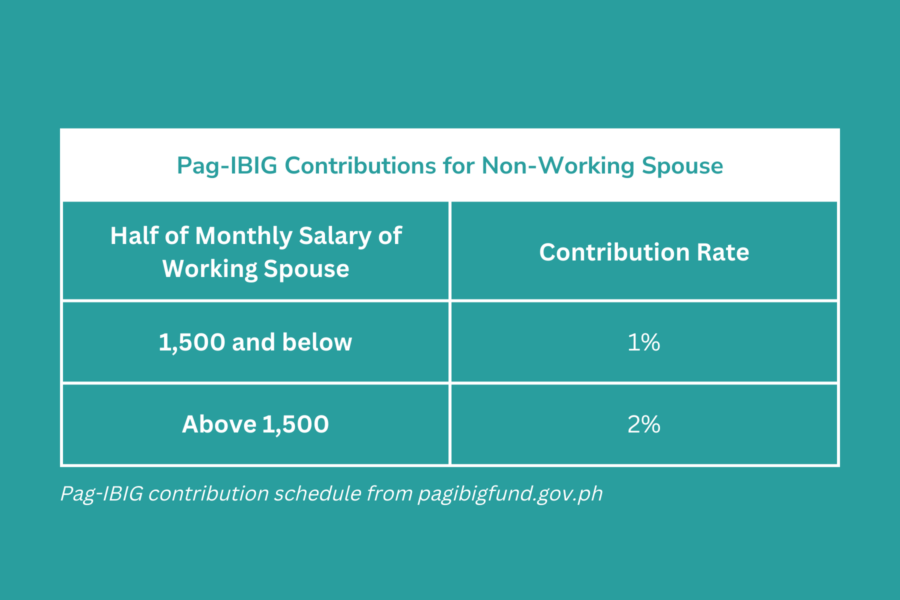

Monthly contribution for a non-working spouse

Non-working Spouse members’ contributions depend on their spouses’ monthly compensation. Suppose half of the spouse’s monthly compensation is less than or equal to Php 1,500. In that case, the member has to pay 1% of half the amount of their spouse’s salary. If half the spouse’s compensation exceeds Php 1,500, the member must pay 2% of that amount.

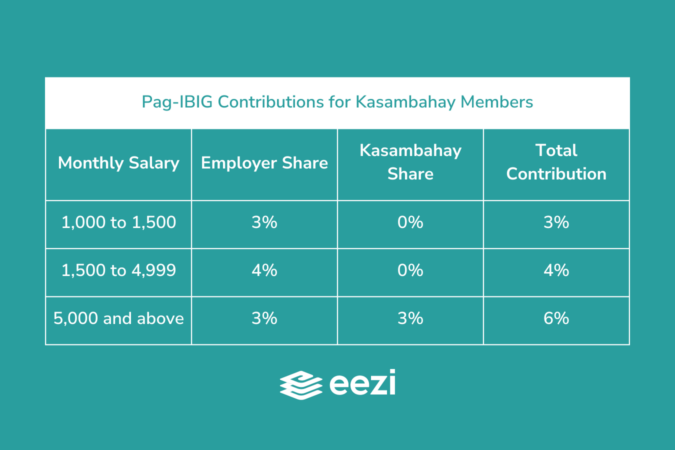

Monthly contribution for Kasambahays

Kasambahay members whose monthly compensations fall below Php 5,000 have their total contributions paid by their employers. However, those earning Php 5,000 and above share the contribution with their employers in equal halves.

Employers of kasambahays earning Php 1,500 or less monthly pay 3% of their employees’ monthly compensations, while those earning more than Php 1,500 but less than Php 5,000 pay 4% of their employees’ monthly payments.

Kasambahays, who make at least Php 5,000, pay half the total contribution, which is 2% of their monthly salary, while their employers pay the other 2%.

Related: Navigate your account using Virtual Pag-IBIG

HDMF offers a good number of services and programs to help its members save. Furthermore, it is the same for acquiring, preserving, or improving their houses. Here are the main programs and services.

Saving programs

Pag-IBIG Fund regular savings

This is where the members’ regular monthly savings go. Regular savings are subject to Pag-IBIG Regular Savings Dividend Rates each year. As such, bigger savings guarantee higher dividends to earn.

Regular Savings reach maturity after 20 years but may be withdrawn earlier due to reasons acknowledged by Pag-IBIG. This includes cases like retirement, permanent disability, or critical illness.

For more info on Pag-IBIG Fund Regular Savings, visit the Pag-IBIG Fund Regular Savings FAQs.

Modified Pag-IBIG 2 (MP2) savings

MP2 savings is a special savings program of Pag-IBIG that allows members to save more and earn higher annual dividends aside from their regular savings. These savings mature after five (5) years, but can also be withdrawn prematurely due to reasons acknowledged by Pag-IBIG.

MP2 savings earn a higher dividend rate than regular Pag-IBIG savings. It is also possible to open several MP2 savings accounts simultaneously.

For more info on MP2 Savings, visit the Pag-IBIG Fund MP2 Savings FAQs.

Housing loans

Pag-IBIG Fund housing loan

Pag-IBIG Fund Housing Loan is a loan that may be granted to members who have paid at least 24 months of contributions to buy a lot or residential unit, house construction or improvement, purchase of a residential house, townhouse, or condo unit or refinance of existing house loan.

In addition, this loan allows members to borrow up to six million pesos (Php 6,000,000) at low rates, depending on the chosen repricing period.

For a guide on applying for and paying Pag-IBIG Fund Housing Loan or additional info on Pag-IBIG Fund Housing Loan, visit the official website.

Pag-IBIG Home Equity Appreciation Loan (HEAL)

Pag-IBIG HEAL is a loan granted to qualified members with existing Housing Loans. The amount given is dependent on the net amount of their home. Additionally, members can avail of this loan for several purposes, such as home improvement, education or health expenses, capital for business, or travel and leisure.

For a guide on the application and payment for Pag-IBIG HEAL or for additional info on Pag-IBIG HEAL, visit the official website.

Pag-IBIG Fund’s Affordable Housing Program (AHP) for minimum wage earners

The Pag-IBIG Fund’s AHP program aims to help qualified members who are minimum-wage or low-income earners. Furthermore, this loan is much the same as the Pag-IBIG Housing Loan, just with lower interest rates to make it affordable for less privileged members.

For a guide on the application and payment for the AHP or additional info on the program, you may visit the Pag-IBIG website.

Pag-IBIG Fund Home Saver Programs

The Home Saver Programs are programs devised by Pag-IBIG to help Housing Loan borrowers cope with missed payments or unpaid amortizations. Home Saver Programs have options for borrowers with 3-9 months’ worth of missed payments and those with more than nine (9) months’ worth of unpaid amortizations.

To know more about the options provided by the Pag IBIG Fund Home Saver Programs, proceed to the Pag-IBIG website.

Short-term loan

Pag-IBIG Fund Multi-Purpose Loan (MPL)

The MPL is a short-term cash loan granted to members who need urgent financial assistance. Under this loan, the maximum amount members can avail is equal to 80% of the member’s current Pag-IBIG Fund Regular Savings. Pag-IBIG can process the MPL as soon as two (2) days after application.

To view the requirements and procedure for the Pag-IBIG Fund MPL and additional info, visit the Pag-IBIG website.

Pag-IBIG Fund Calamity Loan

The Calamity Loan is a short-term cash loan program that aims to provide immediate financial assistance to members who are residing in places under a state of calamity and are therefore experiencing the effects of such calamities. The calamity loan amounts come with a yearly interest rate of 5.95% and is payable within 24 or 36 months.

To view the requirements and procedure for the Pag-IBIG Fund Calamity Loan, you may check out the Pag-IBIG website.

How do members pay for their contributions?

There are several ways for Pag-IBIG members to pay their monthly contributions. Employed members get their contributions deducted from their salaries for their regular savings. Employers are mandated to remit the deducted amount and their share of the contribution to Pag-IBIG on the assigned date; otherwise, a penalty will be incurred.

Suppose the member has loans or other savings accounts opened (like MP2). In that case, the member may opt to have their employer deduct the appropriate amount from their salary or pay them separately by themself.

Self-employed and voluntary members must pay their contributions themselves. Below are some of the ways they can make their payments.

Pag-IBIG branches

Members who want to give their contributions in cash may go to any Pag-IBIG branch and do so. To pay their contribution, they must remember to have their Pag-IBIG MID Number or a printed Member Data Form (MDF).

Virtual Pag-IBIG

The Virtual Pag-IBIG allows members to make their payments online. However, the member must first have an account with the Virtual Pag-IBIG. Furthermore, Virtual Pag-IBIG enables members to pay using credit or debit cards or E-wallet accounts like GCash or Paymaya.

Accredited payment centers

Members may also visit payment centers authorized by Pag-IBIG to collect the members’ contributions. The member must have their Pag-IBIG MID Number (or MP2 account number if paying for MP2) to have their contribution credited to their account. Additionally, there are accredited payment centers like Bayad Center, M Lhuiller, and SM Bills Payment counters.

GCash, Paymaya, and other e-wallets

Another way to pay the contributions is to use e-wallets like GCash. A member must, of course, have a registered and verified account with their chosen e-wallet and sufficient account balance along with their Pag-IBIG MID number or MP2 account number.

7-Eleven

Members of Pag-IBIG can use the ECPay Online Portal to make their contributions. But first, the member must register their mobile number with the ECPay Online Portal.

In addition, they must fill out all required fields on the form and validate their Pag-IBIG MID Number or MP2 Account Number, and choose to pay at 7-Eleven.

After that, a screenshot or printed copy of the resulting 7-Eleven instruction page must be presented to the 7-Eleven counter and the appropriate amount within 24 hours of the ECPay transaction to validate the contribution.

OFWs who pay their contributions by themselves may pay through Overseas Remittance Channels.

Pag-IBIG calculations made eezi

Unload the burden of Pag-IBIG computations and payment remittance from your HR with an automated payroll system. With eezi, our software can shoulder those tasks for your HR—quickly and accurately.