Learn how to compute your PhilHealth monthly payment and its benefits.

PhilHealth, or the Philippine Health Insurance Corporation contribution, is one of the fundamental government-mandated benefits for employees in the Philippines. To find how much of your monthly salary is paid to PhilHealth, the formula is as follows:

How to compute PhilHealth Contribution 2024

Premium Rate x Monthly Basic Salary

The resulting amount is then divided equally between the employer and the employee. This applies to employees in the private and public sectors.

For example:

Let us say an employee is earning Php 20,000 in basic salary. We multiply this amount by the adjusted premium rate for 2024, which is 5% or 0.05.

Contribution rate:

20,000 x 0.05 = 1,000

The resulting Php 800 is then divided equally between the employer and the employee:

Employer share: Php 500

Employee share: Php 500

PhilHealth Premium Contribution 2024 Schedule

Below are the new guidelines from the Philippine Health Insurance Corporation (PhilHealth) for the adjusted contribution rates starting 2024.

How much was the PhilHealth contribution increase in 2024?

The Philippine Health Insurance Corp. (PHIC) or PhilHealth, released an advisory on May 11, 2022, to formally inform the public of its adjusted premium rate for 2022. The PhilHealth advisory cites Republic Act 11223 or the Universal Health Care (UHC) Act, which requires an increase of 0.5 in premium rate annually, beginning in 2019. As such, the new premium rate for 2024 is now 5% for direct contributors.

PhilHealth Contribution Table for Private Employees

What is the PhilHealth contribution rate for 2024?

Starting in 2024, PhilHealth further increases the contribution rate to five percent (5%) in accordance with the Universal Healthcare Law.

PhilHealth Contribution 2024 (Up to 2025)

| Premium Rate | Monthly Basic Salary | Premium Rate |

| 2022 | Php 10,000 to Php 80,000 | 4% |

| 2023 (suspended hike) | Php 10,000 to Php 80,000 | 4.5% |

| 2024 | Php 10,000 to Php 100,000 | 5% |

| 2025 | Php 10,000 to Php 100,000 | 5% |

Citing difficult times, the Palace has released a memorandum order suspending the scheduled increase in PhilHealth contributions under the Universal Health Care Act. However, the agency has decided to proceed with the increase in the PhilHealth contribution rate for 2024. As a result, the rate is now 5%. Furthermore, the income ceiling for monthly contributions has also increased to at Php 100,000 for 2024.

The income floor where the contribution rate is applicable will remain at Php 10,000, and the income ceiling is now Php 100,000. For those daily paid employees with no fixed monthly basic salary, the estimated equivalent monthly rate will be the basis for the PhilHealth premiums. Furthermore, it is not mandatory for indigents, 4Ps beneficiaries, unemployed senior citizens, and PWDs to pay PhilHealth contributions.

Related:

How much is the PhilHealth monthly contribution for 2024?

Below is a sample computation table of the monthly paid premium contribution rates based on the employee’s basic salary. The computation for the PhilHealth monthly payment does not include overtime pay, sales commissions, and other gratuity payments.

Following the most recent PhilHealth circular, the premium rates have been adjusted from four percent to five percent.

As a result, the following is a table for the sample computations for different salary ranges:

How do PhilHealth members pay premiums?

For private employee contributors:

Private employers deduct the PhilHealth premium from the employee’s salary, but employers do not do it manually. PhilHealth has a platform called the Electronic Premium Reporting System (EPRS) that speeds up the preparation and submission of PhilHealth reports. As such, employers can register, enroll, and pay their employees’ premiums easily and conveniently.

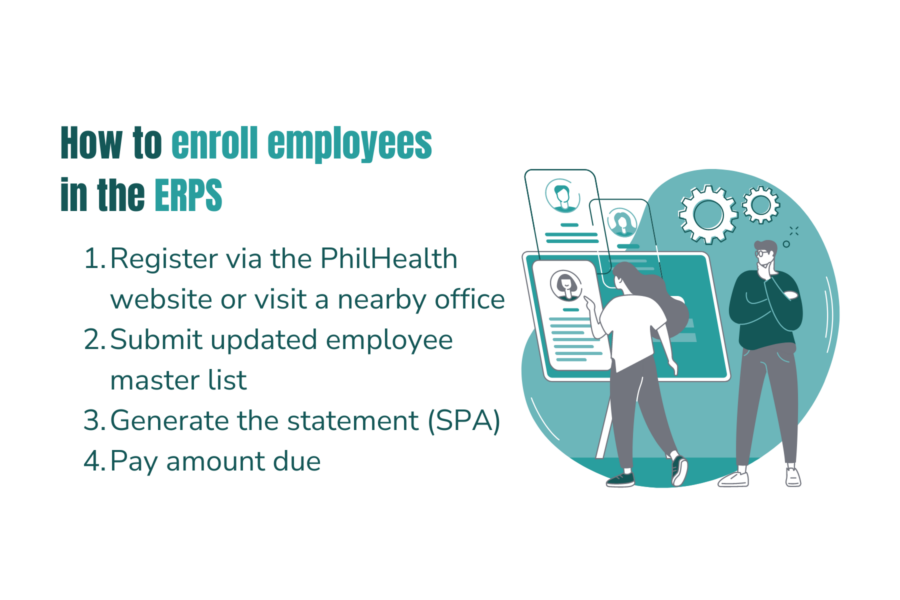

To enroll employees in the electronic premium remittance system (EPRS), employers have four major steps to follow:

- Register online or walk in at any PhilHealth branch.

- Update your employee master list online, either individually or in bulk.

- Generate the Statement of Premium Account (SPA) as the basis for payment.

- Pay the amount due via PhilHealth’s partner banks or any other accredited collectors. Once premium payments are made, they will be validated and posted within three days.

Currently, the PhilHealth website states that they require all employers to pay using the ERPS.

For self-paying members:

Alternatively, self-paying members can pay their contributions by logging into the PhilHealth member portal. From there, they could generate a SPA, which will serve as the billing statement. Additionally, self-paying members can choose how long they will pay. Once all the desired ranges are set, the site generates the amount and due date.

How can employers settle the PhilHealth premium differential payments?

Employers who have not made payments for the adjusted PhilHealth contribution rate still have until the end of the year to settle the differential amount. The corresponding Statement of Premium Account is also automatically available in the ERPS.

What was the maximum contribution for PhilHealth in 2022?

As previously mentioned, the income ceiling for PhilHealth contributions in 2022 was Php 80,000. Moreover, the maximum premium in 2022 was Php 4,000. This meant an equal share of Php 2,000 between the employer and the employee.

How much was the minimum contribution for PhilHealth in 2023?

Following the increase in contributions for 2022, the minimum premium for PhilHealth in 2023 was Php 400 for those earning Php 10,000. When divided equally between the employer and the employee, the minimum contribution for an employee earning a fixed monthly basic salary was Php 200.

How can PhilHealth members check their total contributions?

Members can check their total PhilHealth monthly payment contributions and breakdown on PhilHealth’s official website by following these steps:

- Go to PhilHealth’s official website and click on the ‘Online Services’ section.

- Click the ‘Member Portal’ section to either sign in or register.

- For signing in, you will need your PhilHealth number and password. Alternatively, signing up would require your PhilHealth number, a new password, and answering a security question.

- Once you are in the member portal, you can click the ‘Premium Contributions’ to see the updated summary of your monthly premium and paid periods.

What if I can’t pay my PhilHealth premiums?

Not everyone can pay PhilHealth premiums, especially the elderly, PWDs, and unemployed population. In these cases, they may undergo assessment and become “indirect contributors” where their premiums are subsidized by the national government.

Under direct contributors are:

- Indigent individuals and families identified by the Department of Social Welfare and Development (DSWD)

PhilHealth benefits

Under RA 11223, also known as the Universal Healthcare Law, all Filipinos are PhilHealth beneficiaries. But what benefits does PhilHealth provide?

Inpatient Benefits

PhilHealth members who are hospitalized can have a portion of their bill shouldered by PhilHealth, provided that the health care institution (HCI) is a partner of the agency. The covered amount includes hospital rates and the attending physician’s professional fee. Lastly, PhilHealth can only reimburse admitted cases under inpatient benefits.

Outpatient Benefits

PhilHealth also offers financial assistance to patients who do not need hospital admission. The agency can cover the cost of day surgeries, radiotherapy, hemodialysis, and outpatient blood transfusion. The case rate for the sessions varies and is also inclusive of hospital charges and the physician’s fees.

Z Benefits

The ‘Z Benefit’ package covers illnesses that cause long hospitalization and costly treatments. As such, PhilHealth can cover a portion of the cost of treatment for diseases like leukemia, breast cancer, prostate cancer, kidney transplants, heart surgery, and cervical cancer.

SDG Related Benefits

SDG Benefits: Sustainable Development Goals benefits provide an assistance package for malaria, HIV-AIDS, tuberculosis, surgical contraception, and animal bites.

Legal basis of PhilHealth

The National Health Insurance Program (NHIP) is a mandatory government health insurance program that aims to provide universal healthcare for all Filipinos. Furthermore, it also aims to make healthcare services affordable and accessible for everyone. PhilHealth was created by the Republic Act (RA) 7875 and amended by the succeeding RA 9241 and RA 10606.

Simplify PhilHealth contribution calculations with eezi

Enroll employees in eezi’s payroll software and compute PhilHealth contributions in a few clicks. Learn more on how to configure your payroll system for PhilHealth contributions.