Here is your guide to computing back pay based on the DOLE Labor Advisory.

Leaving work permanently always gives us mixed feelings whether we do it of our own volition or through other means. However, there are certain things that we expect when we leave our previous jobs.

Upon resigning or termination of employment, employees in the Philippines expect to receive their COE and, of course, the final pay.

What is back pay?

DOLE defines back pay as the accumulated amount of all wages and monetary benefits. It also includes the monetary equivalent of all convertible benefits due to the employee. The same is true no matter the reason for their separation from work.

Back pay is defined as an accumulation or summation because it is composed of several different benefits.

DOLE’s Labor Advisory no. 06, series of 2020 or LA 06-20, serves as guidelines on the payment of final pay or back pay for both employers and employees. LA 06-20 is pursuant to the Labor Code of the Philippines.

The issuance of a Certificate of Employment is usually within three (3) days from the date of request. The back pay is within 30 days of the employee’s last work date. This could mean either the date of resignation or termination of employment.

Though this rule is specifically stated in LA 06-20, a more favorable company policy might be in place and enforced.

Related: Requesting a Certificate of Employment

How is back pay different from final pay?

Back pay is generally defined as wages already earned by the employee. But what makes it “back” pay? It is when the employer fails to release to the employee at the time it was earned. Otherwise, it is known as an unpaid earned salary. Extreme examples of such include salary theft or violations of the minimum wage laws.

Final pay, on the other hand, is the general term used for the last payment given to employees. Such is given as their employment is ended. Final pay usually includes unused leaves and any outstanding wages.

DOLE’s Labor Advisory no. 06 of 2020 uses final pay and back pay to mean the same thing. In addition, they can be used interchangeably. This will also be the case for this article, where final pay and back pay will be taken into account.

Here, it is also referred to as “the last and total compensation given to an employee as their employment contract comes to an end or is terminated” and will be used interchangeably.

Related:

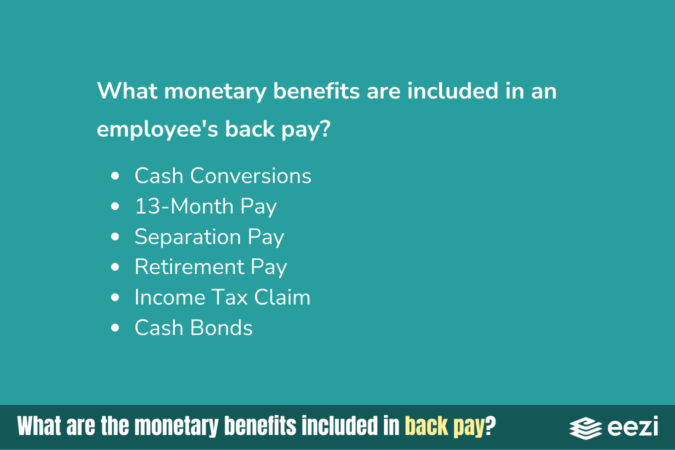

What monetary benefits are included in an employee’s back pay?

Aside from the employee’s unpaid salary, the employee may also receive the following:

Cash conversions

Unused service incentive leave (SIL) is convertible to cash in accordance with the Labor Code of the Philippines. The cash equivalent of the unused SIL is given to the employee as part of their final pay. Unused vacation leave, sick leave, and other types of leave may also be converted to cash. However, this depends entirely on the company policy.

13th-month pay

The 13th-month pay is not only for regularized and long-term employees. Any employee who has worked for the company for at least a month in the year the employment ended shall receive the pay. If not previously issued, the employee will get a prorated amount of their 13th-month pay as part of their final pay. That is if the contract ends before the completion of 12 months’ worth of service during the year.

Separation pay

Not every employee leaving a company is entitled to receive separation pay. Employees who resign or are terminated due to Just Cause are not entitled to receive separation pay. The release of separation pay is regulated by the Labor Code and may be released in accordance with company policy or any individual or collective agreement. The Bureau of Working Conditions under DOLE released a statement last February 15, 2022 further clarifying separation pay.

Related: Rules on Preventive Suspension (DOLE)

Retirement pay

An employee whose employment contract is ended due to retirement is eligible to receive retirement benefits that they have earned under the laws of the Philippines, any collective bargaining agreement, or other agreements.

Suppose the company does not provide retirement plans or agreements. In that case, employees who are 60 years of age and above but not over 65 and have served the current company for at least five (5) years are entitled to receive half a month’s salary for every year of service rendered as retirement pay. Incomplete years with at least six (6) months of service are considered as one year.

Income tax claim

A dismissed employee is entitled to claim any excess in taxes withheld from their salaries and have the amount added to their final pay. These are also called tax refunds.

Cash bonds

An employee, upon their dismissal from the company, is eligible to receive any cash bonds or deposits that are bound to be returned to them and have them added to their back pay.

Other adjustments

An employee’s last pay may also include other monetary benefit claims not included in the above discussions.

Who can receive back pay?

All employees who have their employment ended, through resignation, end of the contract, or contract termination, may receive their final pay. Furthermore, their employers must release the same within thirty (30) days of the termination of employment.

When is the final pay released?

LA 06-20 mandates the release of back pay within 30 days from the date of resignation or termination of employment as a general rule. It applies unless a more favorable company policy, individual or collective agreement thereto, is in place.

How much is given as back pay?

The amount of back pay or final pay released to a former employee varies for each case. There are many factors affecting the amount of back pay that an employee may receive, like the ones mentioned above.

Is back pay taxable?

Yes, under the TRAIN Law, back pay is taxable like a regular personal income.

Is back pay mandatory?

Back pay is a post-employment benefit that both resigned employees and terminated employees usually receive. However, this is not mandatory in the Philippines and is usually dependent on your organization’s own company policy. For the amount, it may include portions of your monthly salary and other benefits minus deductions.

What documents do I need to submit before I receive my back pay?

Of course, you must send in your resignation letter if you are quitting. Moreover, you must make sure you are responsibly turning over company liabilities. For instance, you need to surrender a laptop or other company-issued equipment, which will require clearance from your IT department. Depending on your role and company policy, these requirements may vary.

Aside from back pay, what exit documents do I receive?

In addition to your back pay, companies usually also release the following documents:

- Release waiver and quitclaim

- BIR Form 2316

- Certificate of Employment

Do I receive my back pay in cash?

Usually, your back pay is issued the same way that your payroll is. If you receive your salaries through bank transfer, then you can expect the same method for your back pay.

How to compute back pay in the Philippines in 2024?

We may use this formula in a sample back pay computation:

Back Pay = Total Earnings – Total Deductions

Back Pay = Total unpaid earned salary + Total cash conversion of unused SILs and other leaves + Full or pro-rated 13th-month pay + Separation pay (if applicable) + Retirement pay (if applicable) + Tax refunds + Total other monetary benefits and cash bonds + Monetary incentives (if any)

You may also use an online back pay calculator to estimate the amount.

For the unpaid salary, the formula is as follows:

Earnings – Deductions = Unpaid Salary

Comply with back pay regulations through eezi

Worried you’ll make a mistake in computing your employees’ back pay? Worry no more! eezi‘s got your back. With eezi HRIS and payroll, back pay computation is a breeze. Try eezi now!